This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Complete Crypto Options Solutions

An Ecosystem for Trading Options and Volatility Powered by a Breakthrough Automated Market Maker (AMM)

DeVol is the only platform for low-cost, fully on-chain multi-leg option trading with democratized liquidity provisioning.

- Form a market opinion

- Execute multi-leg trades with no leg risk

- Analyze strategies pre and post execution

- Understand and manage risk

All in one place

Platform

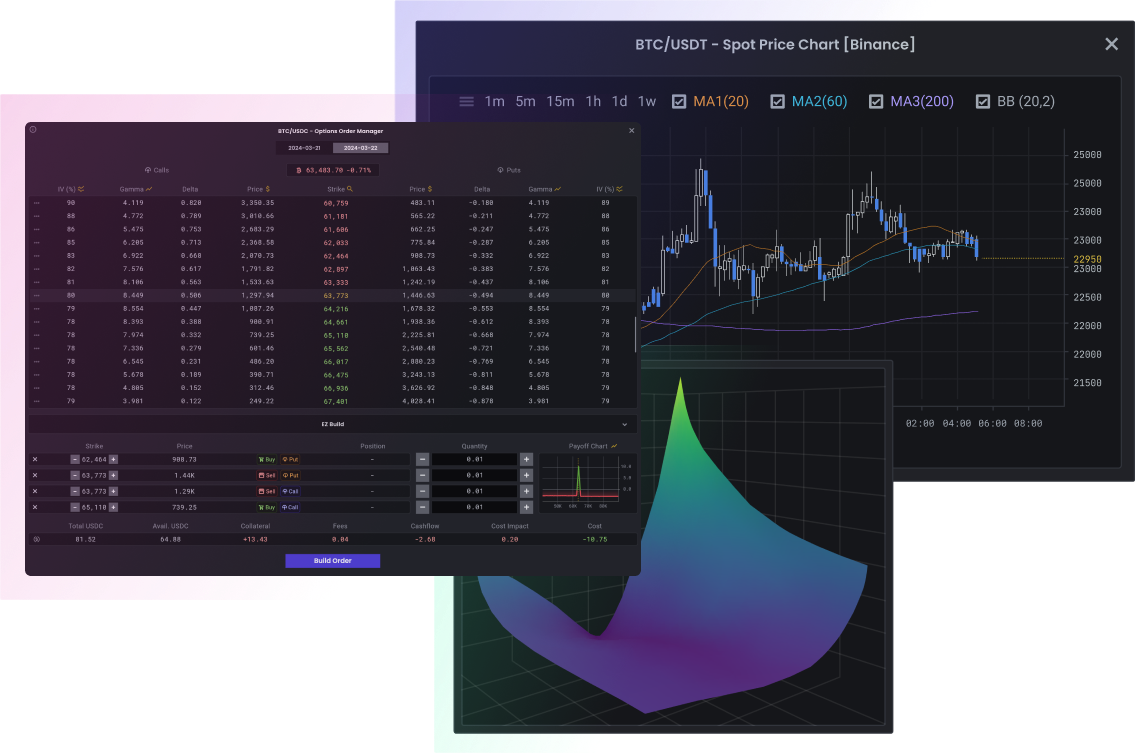

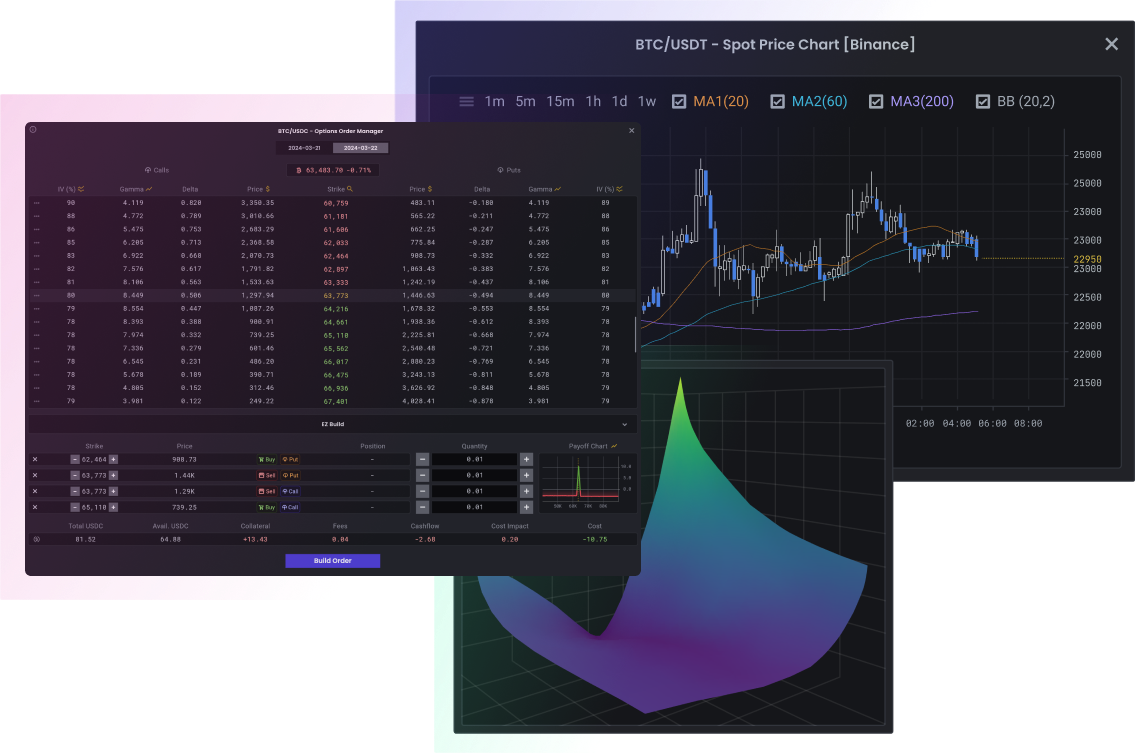

Advanced Trading Capabilities

Access industry leading liquidity across all strikes

with on-chain pricing and settlement that allows for transparency and lower fees.

- No bid-ask spread

- Fully collateralized

- Minimum of 95 granular strikes

- Execute multi-leg trades in a single order

Generate Yield from Market Making

Provide liquidity for options on an even playing field and earn passive yield.

- Capital efficient for liquidity providers

- No active trading necessary

- Automatically supply capital as

collateral across all strikes

Quantitative Strategies

with a suite of automated, risk-managed strategies.

Analytics

to research, execute, and monitor trades.